THE PROBLEM

How do I get rid of old uncleared bank transactions from my Bank Reconciliation? How Do I reverse a Stale Cheque?

This can happen You have uncleared transactions in your Bank Reconciliation that are either old unpresented cheques or old uncleared expenses (probably entered in error or duplicated).

DISCUSSION

Unpresented Cheques may be sitting in your Bank Reconciliation if the cheque is unpresented, or if it is a duplicate entry in Reckon. Under the Cheques Act 1986, a check is considered stale after 15 months.

Uncleared expenses, unless they are only a day or two old, and normally the result of a duplicated transaction or an error.

Either way, these transactions need to be fixed.

DON’T JUST DELETE OR VOID THE TRANSACTION! If they are in the previous GST or accounting period, this could affect previous GST returns, management reports, or tax returns already lodged. The best way is to just reverse the transaction in the current period.

THE FIX

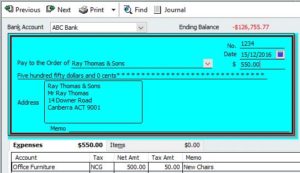

Step 1 – Note the Initial Entry.

The first step is to open the cheque that is stale and note what account it has been allocated against and the GST amount.

Step 2 – Reverse with a General Journal

You can then prepare a journal entry via Company > Make General Journal Entry as follows:

Note that I have dated this transaction as today, and I have reversed the initial office furniture expense and GST.

If you are unfamiliar with Journal Entries or debits and credits, this can look as if the bank entry is the wrong way around; it is correct. A debit in our books is represented as a credit in the Bank’s books. This is because from our books point of view we have an asset (money in the bank – a debit), whilst the bank has a liability (money owed to customers – a credit).

Step 3 – Document what you have done

It’s a good idea to go back into the original cheque and add a note on the memo as follows: Cheque Stale – Reversed dd/mm/yyyy (Make no other changes!). I would also make a note on the Customer/Supplier record.

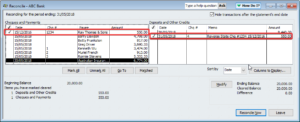

Step 4 – Clear the Transactions in the Bank Reconciliation

Now you can get rid of them from your Bank Rec. When doing your next Bank Rec, simply click the transactions on both sides, making sure that the transactions are of equal value. Simple as that.

OTHER CONSIDERATIONS

Other factors you may need to consider are:

- If the initial transaction was a Bill Payment

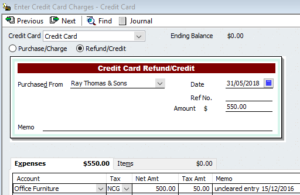

- If the initial transaction was a credit card, then you can use a Credit Card Refund/Credit instead of a Journal Entry in Step 2.

- if the initial entry was a deposit, the same process applies, except the General Journal Entry in Step 2 would be reversed so it is Credit Bank Account and Debit Income Account.

- if the initial entry was a deposit, the same process applies, except the General Journal Entry in Step 2 would be reversed so it is Credit Bank Account and Debit Income Account (but read on to the second last dot point).

- if the initial entry involved inventory items, then the process is a little more complex as the initial adjustment to inventory (for an expense) may have subsequently been adjusted by a stock take. If this is the case, the allocation account used to reverse the entry would be the company’s Stock Losses/Adjustment account.

- if the initial entry was a sale involving inventory items, you will need to reverse not only the sale but also the inventory movement. From the initial entry, run the Journal Report (look for the Journal button on the bar with Next, Previous, email etc) and note the whole journal. Note also the above point re stocktakes – same issue.

- if the initial entry was a Customer Payment, you may still be owed the money!

Graham Boast 0409317366

Reckon Accredited Consultant

graham@reckonhelp.com.au

Recent Comments